Alternative Minimum Tax Rate 2025. It is paid in addition to ordinary income tax. Secondly, a host of tax benefits and deductions.

Tax Rates AS202425 PDF Alternative Minimum Tax Tax, In contrast, regular tax rates start at 10% and cap out at 35%.

Tax rates for the 2025 year of assessment Just One Lap, An increase to the federal amt rate from 15% to 20.5%.

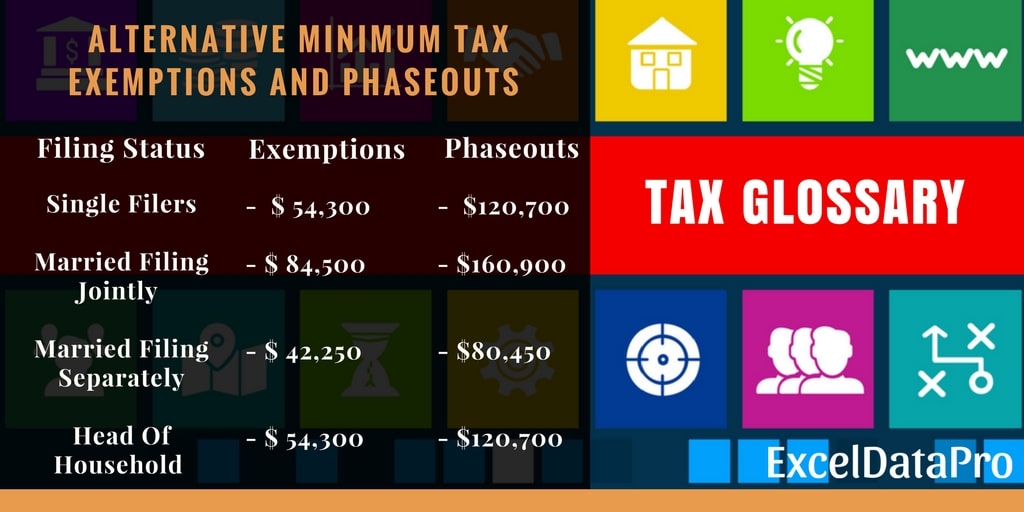

Corporate Alternative Minimum Tax Details & Analysis Tax Foundation, It takes into account the exemption amount, which is the part of your.

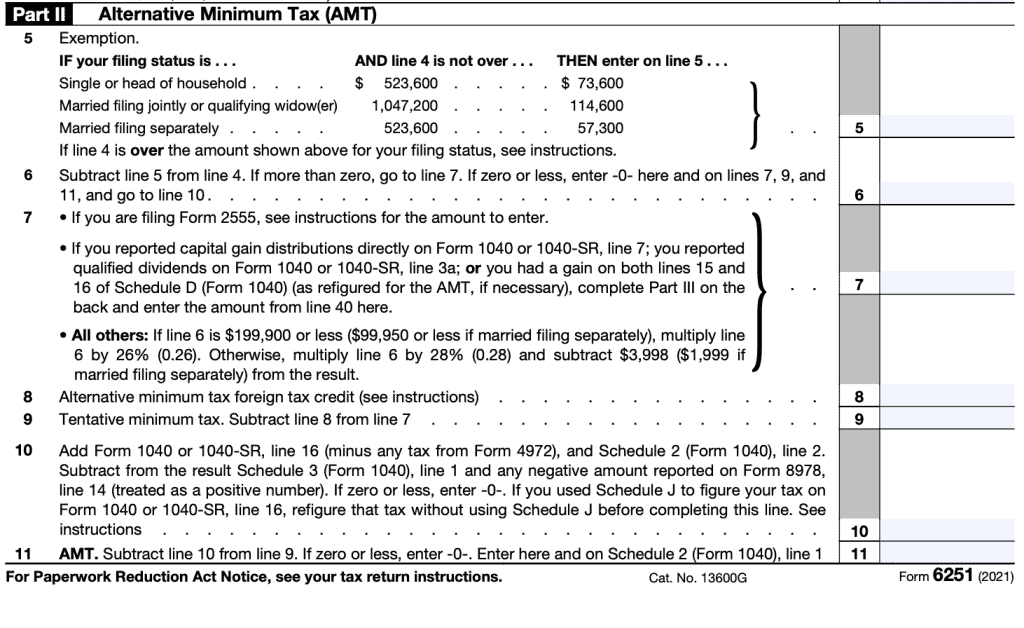

IRS Form 6251 Instructions A Guide to Alternative Minimum Tax, For municipal bonds, yield is represented by taxable equivalent yield, which is based on the top federal bracket (37%) and net investment income tax (3.8%).

Who is Subject to the Alternative Minimum Tax (AMT)? Tax Foundation, The alternative minimum tax (amt) rate will be raised from 15% to.

What To Know About the Alternative Minimum Tax, The result will display an estimate of your alternative minimum tax.

Tax Rates For FY 202324 (AY 202425) PDF Alternative, The alternative minimum tax rate is 28% for alternative minimum taxable income up to a maximum of $232,600 (for 2025) for returns of married couples and.